44+ is reverse mortgage interest tax deductible

It is not - unless you paid off the loan in full. The terms of the loan are the same as for other 20-year loans offered in your area.

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

Web The tax-deductible status of reverse mortgages can be a tricky thing to figure out as the answer relies on several factors.

. Indeed it is a question that doesnt really. Taxes Can Be Complex. 13 1987 your mortgage interest is fully tax deductible without limits.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Web Some fees may be tax deductible on a reverse mortgage such as the origination and broker fees. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web If you took out your mortgage on or before Oct.

Web In fact the mortgage interest tax deduction primarily benefits taxpayers making more than 200000 according to the Tax Foundation an independent. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible.

Depending on the plan your reverse mortgage becomes due with interest when you move sell your. For tax year 2022 those amounts are rising to. Ad Compare the Best Reverse Mortgage Lenders.

For Homeowners Age 61. Ad Learn How a Reverse Mortgage Can Help You Strengthen Your Safety Net in Uncertain Times. Web 1 Best answer.

February 13th 2012 at 844 am. For Homeowners Age 61. Ad Millions Of Senior Americans Enjoy Financial Security Through A Reverse Mortgage.

Web The short answer is. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Comparisons Trusted by 45000000.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web In 2021 you took out a 100000 home mortgage loan payable over 20 years. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

If the borrower dies without having made any interest payments on their. I thought I would get a straight forward answer to a simple question here. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

June 4 2019 1229 PM. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Ad Learn How a Reverse Mortgage Can Help You Strengthen Your Safety Net in Uncertain Times.

Web 12 Responses to Is Reverse Mortgage Interest Tax-Deductible. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Get A Free Information Kit.

Find Out In Less Than 2 Minutes If A Reverse Mortgage Is Right For You. You paid 4800 in. Also if your mortgage balance is.

You can deduct amounts you paid for qualified mortgage insurance premiums on a reverse mortgage. Web Yes and maybe. Web June 5 2019 1201 PM.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Web With a reverse mortgage you retain title to your home. Ad 2023s Trusted Reverse Mortgage Reviews.

Any interest including original issue discount. It all depends on how the property is used. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

![]()

Repayment Of The Hecm Loan Balance And The Tax Issues

Mortgage Interest Tax Deduction Smartasset Com

Mortgage Interest Tax Deduction What You Need To Know

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Pdf Lane M F Landholding At Pa Ki Ja Na Michael Lane Academia Edu

Mortgage Interest Tax Deduction What You Need To Know

Race And Housing Series Mortgage Interest Deduction

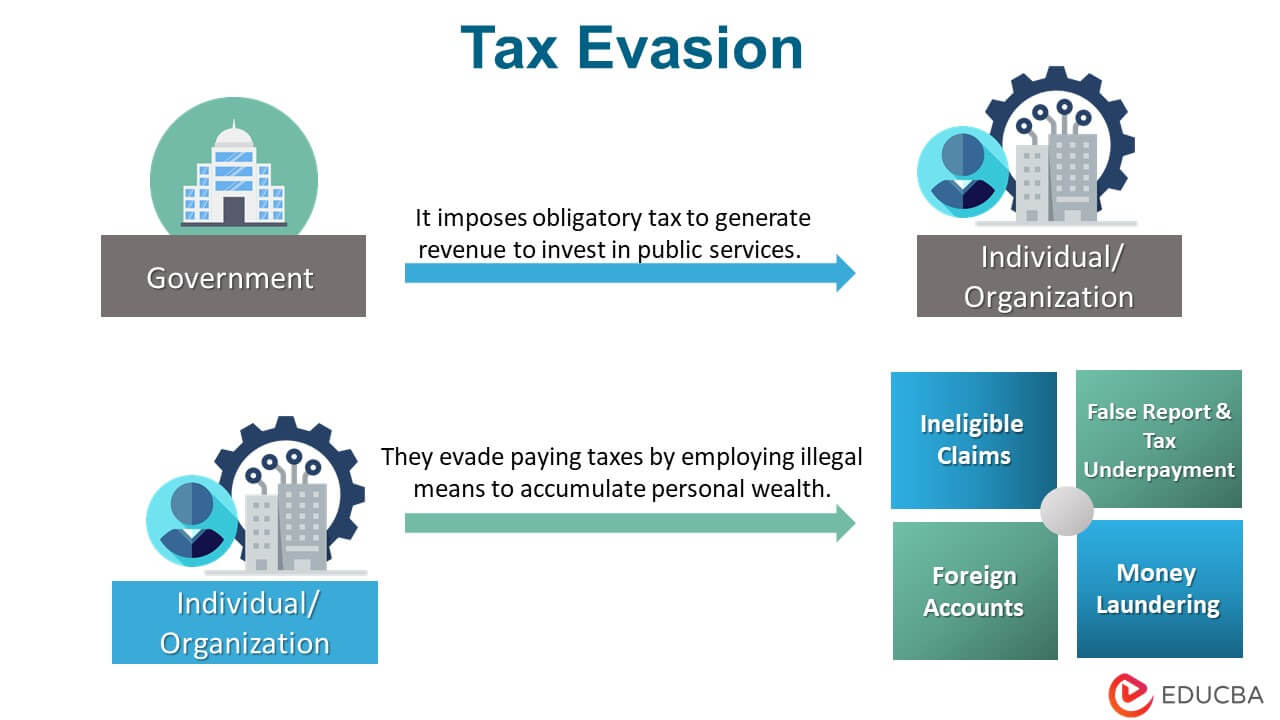

Tax Evasion Meaning Penalty Examples Cases

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Free 10 Mortgage Payoff Statement Samples In Pdf

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

Home Mortgage Loan Interest Payments Points Deduction

The Irs Treatment Of Reverse Mortgage Interest Paid

The Complete Idiots Guide To Buying A Piano Pdf Piano Box Zithers

6 Tax Breaks Every First Time Homeowner Should Know About